Confidence among builders in the U.S. housing market plunged for the third straight month in October as a spike in mortgage rates continued to weigh on consumer demand for new homes.

The National Association of Home Builders/Wells Fargo Housing Market Index, which measures the pulse of the single-family housing market, fell five points to 40, the lowest reading since January 2023. The decline followed a five-point drop in September.

Any reading below 50 is considered negative.

“Builders have reported lower levels of buyer traffic, as some buyers, particularly younger ones, are priced out of the market because of higher interest rates,” said NAHB Chair Alicia Huey, a custom home builder and developer from Birmingham, Ala. “Higher rates are also increasing the cost and availability of builder development and construction loans, which harms supply and contributes to lower housing affordability.”

HOME FORECLOSURES ARE ON THE UPSWING NATIONWIDE

Sentiment among builders had been steadily rising earlier this year as limited resale inventory pushed would-be buyers to seek out new construction instead. But when mortgage rates shot above 7% in September, it throttled demand among would-be homebuyers.

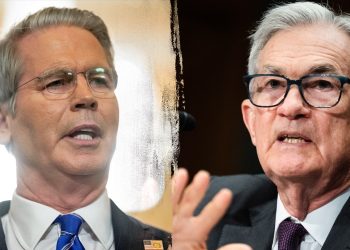

Rates are expected to remain elevated, as the Federal Reserve has hinted that it may hold interest rates at peak levels for longer than previously anticipated.

MORTGAGE CALCULATOR: SEE HOW MUCH HIGHER RATES COULD COST YOU

Rates on the popular 30-year fixed mortgage are currently hovering around 7.57%, according to Freddie Mac, well above the 6.92% rate recorded one year ago and the pre-pandemic average of 3.9%.

It is the highest level in more than two decades.

Sentiment fell across the board in all four regions in the U.S.

Higher rates are also prompting more builders to use sales incentives in order to woo buyers: About 62% of builders indicated they are using all types of incentives, including buying down interest rates, up from 59% in September.

On top of that, builders are cutting prices in a bid to woo buyers. About 32% of builders said they cut home prices in October, the highest rate since December.

“The housing affordability crisis can only be solved by adding additional attainable, affordable supply,” said NAHB chief economist Robert Dietz.

He added: “Boosting housing production would help reduce the shelter inflation component that was responsible for more than half of the overall Consumer Price Index increase in September and aid the Fed’s mission to bring inflation back down to 2%. However, uncertainty regarding monetary policy is contributing to affordability challenges in the market.”

Read the full article here