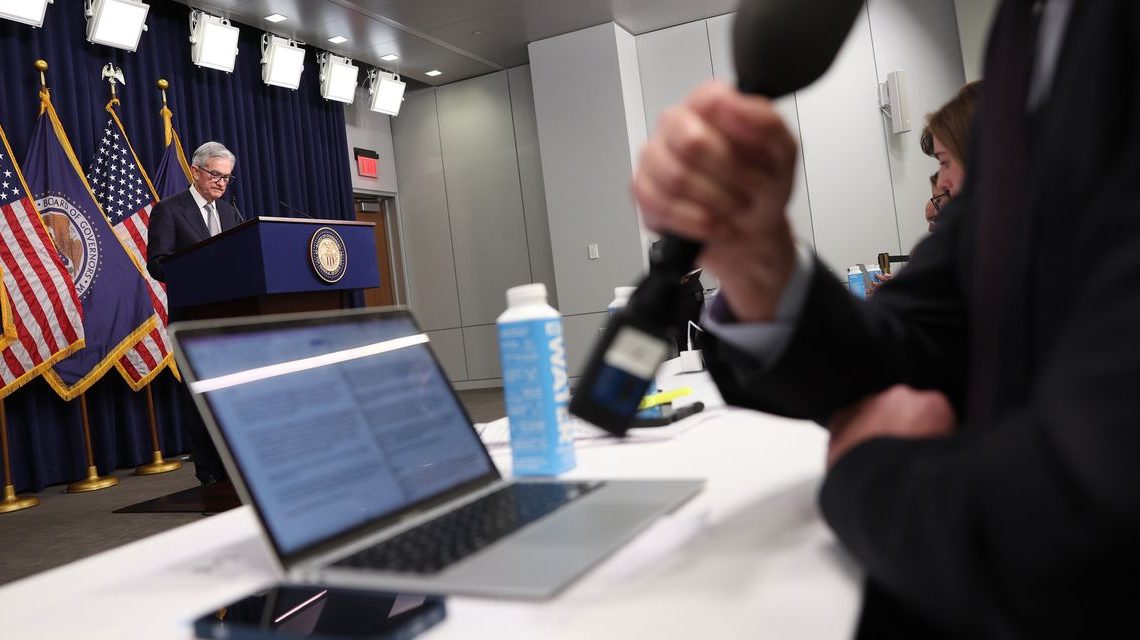

Federal Reserve Chair Jerome Powell’s uncertainty over whether policy makers have raised rates enough didn’t stand in the way of a rally for both stocks and bonds on Wednesday.

The Fed on Wednesday left interest rates unchanged for a second straight meeting, as expected. In September, the policy-setting Federal Open Market Committee’s so-called dot-plot forecast penciled in one more rate rise in 2023.

On Wednesday, Powell said policy makers were asking themselves whether they had hiked enough, and said they weren’t confident rates were yet restrictive enough. That means the Fed is going to take it meeting by meeting, weighing the data as it decides whether it needs to make another move.

“Powell had several opportunities to threaten another rate hike, but passed on most of them,” said Thomas Simons, U.S. economist at Jefferies, in a note.

While stocks fluctuated over the course of Powell’s news conference, major indexes ended the day with solid to strong gains. The Dow Jones Industrial Average

DJIA

rose over 220 points, or 0.7%, while the S&P 500

SPX

advanced 1.1% and the Nasdaq Composite

COMP

jumped 1.6%.

And when it comes to rate expectations, fed-funds futures traders grew more skeptical the central bank will deliver a December rate hike. Market participants have now priced in a 19.8% probability the Fed will lift rates by 25 basis points, or a quarter point, at its final policy meeting of 2023, down from 28.8% on Tuesday. They see an 80.2% chance the Fed stands pat for a third straight meeting.

Treasury yields extended a pullback, aiding the stock-market rally. The 10-year Treasury yield

BX:TMUBMUSD10Y

fell 8.4 basis points to 4.79%, while the 2-year yield

BX:TMUBMUSD02Y

fell back below 5%.

Powell “declined to nudge the market pricing toward the hike that many Federal Open Market Committee members projected at their September FOMC meeting,” said Tiffany Wilding, an economist at Pimco, in a client note.

“Instead, Chair Powell suggested that a continuation of above-trend growth was needed to garner additional rate hikes, and that the current trend growth may be elevated as a result of the postpandemic normalization in immigration, and the more general improvement in labor-force participation,” she wrote.

As a result, Powell reinforced the pricing of around only a 20% chance of a rate hike in December, Wilding said, putting “the onus on the data between now and then to knock them off of that track.”

Read the full article here