The weaker-than-expected July jobs report and large downward revisions to the prior two months’ job gains could signal that the U.S. economy is at a turning point, as Federal Reserve policymakers continue to monitor economic conditions and weigh interest rate cuts.

Fed Governor Lisa Cook spoke on a panel with Boston Fed President Susan Collins at the Boston Fed. Cook said that the report was “concerning” as it could signal the U.S. economy is reaching an inflection point.

“We need to be cautious and humble because we should be monitoring all kinds of indicators. Let’s say, for example, we just received this jobs report and this is concerning, you know, 35,000 jobs per month over the last three months ending in July. And there were major revisions, two major revisions to May and June,” Cook explained. “These revisions are somewhat typical of turning points, which again, speak to uncertainty.”

LEADING ECONOMIST ISSUES STARK RECESSION WARNING FOR STRUGGLING US ECONOMY

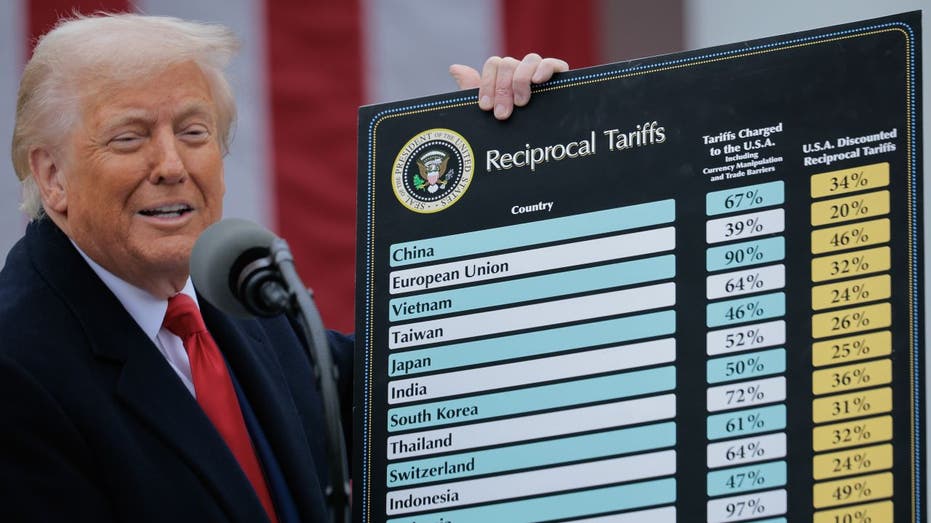

Collins and Cook also discussed the impact of uncertainty on the economy as business leaders look to make decisions on things like hiring, investment and pricing their products when their costs are shifting due to higher tariffs that the Trump administration has implemented.

Cook said she’s been hearing from business leaders about how the “uncertainty tax” is impacting their decisionmaking about things like investment, hiring and pricing.

“The main thing that I’ve been hearing, and I’ve been trying to get more and more precise estimates, is about the uncertainty tax,” Cook said. “So how much time CEOs and CFOs are spending – of all kinds of organizations, financial institutions, small and large businesses, nonprofits – how much time they’re spending per week managing all of this. And to a person, the estimate is between 20 and 45 percent.”

MARKETS NOW BETTING FED WILL CUT RATES IN SEPTEMBER AFTER DISAPPOINTING JOBS REPORT

Cook noted that firms are considering pricing decisions in different ways, saying that “some of them are preemptively raising prices, and some of them are waiting to see what kind of deal they can get from their suppliers.”

“There’s just uncertainty across the board, but I think it’s really interesting that no matter what the sector, no matter what kind of business they’re in, they’re talking about this uncertainty tax,” she added.

Collins added that she has also heard from business leaders about the uncertainty tax and that businesses have been in a holding pattern as they wait to see how consumer prices evolve in response to tariff levels that have shifted as the Trump administration lowers or raises the levies in response to its negotiations with trading partners.

Inflationary pressures in the U.S. economy are down from the 40-year high reached in 2022 and have moved closer to the Fed’s 2% longer-run target, though inflation remains above that level and continues to strain Americans’ budgets.

FED’S FAVORED INFLATION GAUGE SHOWS CONSUMER PRICES ROSE AGAIN IN JUNE

“I do also hear about uncertainty leading to a wait and see in terms of how to think about pricing decisions, especially coming out of a period of high inflation. Of course, it’s come way down, it’s much closer to the target. But that means price levels are very elevated, and that means consumer sensitivity to pricing and price changes is elevated,” Collins said.

“Most of the literature that I’m aware of does focus on real activity, but the idea of a direct uncertainty effect on pricing decisions… frankly wasn’t something I had thought about as much, but it’s certainly something that I’ve been hearing specifically about,” Collins said.

Read the full article here