The Supreme Court on Wednesday will hear arguments in the case challenging the legality of the Trump administration’s tariff regime imposed under a law related to economic emergencies, with tens of billions of dollars in tariff revenues hanging in the balance.

Justices will hear arguments in a consolidated tariff case, known as Learning Resources v. Trump and Trump v. V.O.S. Selections, Inc., which was brought by small businesses who challenged the constitutionality of tariffs imposed by the administration under the International Emergency Economic Powers Act (IEEPA).

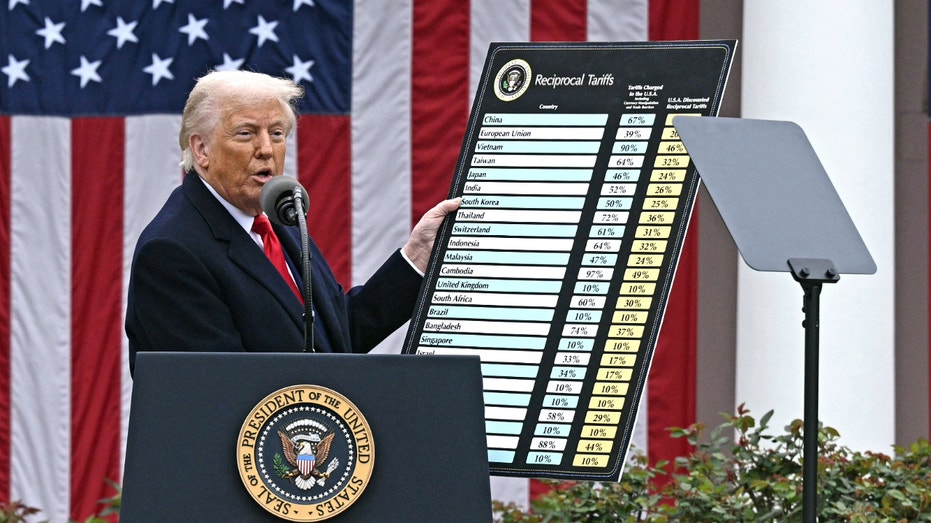

While the Trump administration argues IEEPA grants the president authority to impose tariffs, a federal district court and appeals court rejected that argument and ruled the president exceeded his legal authority under the law, prompting the White House to appeal to the Supreme Court.

Billions of dollars in tariff revenues have been collected from U.S. businesses under the Trump administration’s IEEPA tariffs, which the Tax Foundation estimated have totaled over $88 billion so far this year.

TRUMP WARNS US WILL BE ‘STRUGGLING FOR YEARS’ IF SUPREME COURT RULES AGAINST HIM ON TARIFFS

The Tax Foundation estimated that if the IEEPA tariffs are allowed to remain in effect, they would raise nearly $1.8 trillion in tax revenue over the 2025-34 period, reducing gross domestic product (GDP) by 0.4% and employment by 428,000 jobs before accounting for retaliation from trading partners.

It also estimated the IEEPA tariffs will raise taxes by an average of $1,000 per U.S. household this year, and $1,300 per year thereafter.

The Trump administration has argued that striking down the tariffs would hurt the U.S. economy, and would undercut the president’s efforts to rectify what he sees as unfair trade deals, as well as to reshore manufacturing.

President Donald Trump said on Fox News’ “Sunday Morning Futures” that winning the tariff case is “vital to the interests of our country. We’re the wealthiest country there is. If we don’t, we’ll be struggling for years to come.”

TRUMP SAYS HE WON’T ATTEND SUPREME COURT HEARING ON HIS TRADE POLICIES

Critics of the tariffs argue that they’re causing economic harm, with prices pushed higher as U.S. importers pass their higher tariff costs on to consumers through price hikes. Those have contributed to higher inflation readings in recent months, while uncertainty over tariffs has weighed on hiring.

Dr. Wayne Winegarden, senior fellow in economics at the free-market Pacific Research Institute, told FOX Business that the “economic consequences of the IEEPA tariffs are troubling. Not only are the tariffs directly stagflationary, but they also create the additional uncertainty that is detrimental to future economic activity.”

Winegarden said that while he isn’t a lawyer by trade, the IEEPA tariffs raise constitutional questions and “usurp the taxation powers from Congress and create a gigantic loophole that, if allowed to stand, would allow future presidents to impose tariffs on U.S. consumers and businesses for all sorts of dubious justifications.”

BESSENT SAYS HE’S ‘OPTIMISTIC’ AS SUPREME COURT WEIGHS FATE OF TRUMP’S ENTIRE TRADE AGENDA

It’s unclear how quickly the Supreme Court will rule on the tariff case after Wednesday’s arguments, though it could come in the next several weeks before the end of the year.

Dallas Dolen, U.S. TMT industry leader at PwC, told FOX Business that about $89 billion in tariff revenue has been collected this year and the figure was expected to rise to $108 billion by the end of October — some or all of which could be refunded to the U.S. businesses that paid the tariffs if the Supreme Court rules against the administration.

“If the Supreme Court ultimately rules that the tariffs were unlawful, the full amount could potentially be subject to refund, depending on how the Court structures its decision,” Dolen said.

Dolen explained that the Trump administration hasn’t outlined how it would handle processing refunds to affected businesses, who would likely face “a complicated and time-consuming process” to apply for refunds.

“For now, companies are preparing for several possible outcomes. Many are modeling potential refund scenarios, reviewing their customs data, and ensuring that they can act quickly once the ruling is issued,” Dolen explained. “The businesses best positioned to respond will be those with clear documentation, coordinated internal teams, and readiness to move fast once the process becomes defined.”

Read the full article here