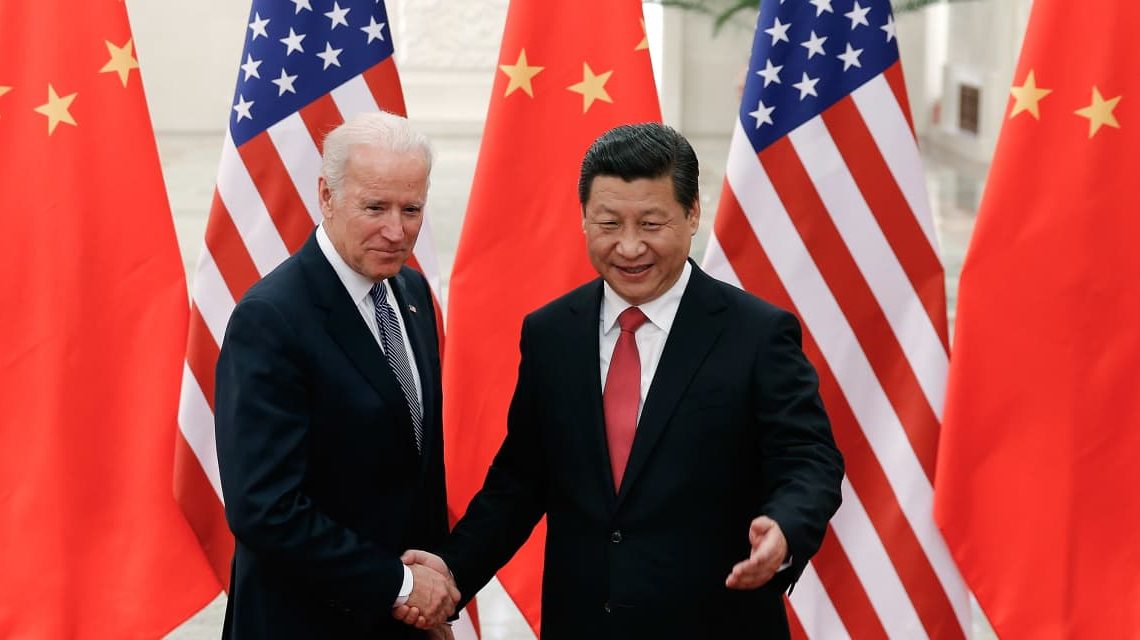

President Joe Biden and Chinese leader Xi Jinping on Wednesday met for four hours and agreed to restart direct communications between their militaries, cooperate to curb the flow of precursor chemicals for fentanyl and discuss the risks of artificial intelligence as they try to keep their rivalry from spiraling into a conflict.

The first in-person meeting between the two leaders in a year was billed by analysts as a reset after the recent blows dealt to the relationship, with Chinese surveillance balloons flown over the U.S., China increasing military exercises over Taiwan following Speaker Nancy Pelosi’s visit to the self-ruled island, and the U.S. tightening a stranglehold on China’s access to advanced technology.

But it’s unlikely to reset investors’ pessimistic view on China just yet, for two reasons. China’s economy is still struggling and the rivalry between the two countries remains. And the areas of disagreement show no signs of abating despite the leaders’ efforts to steady the relationship, including vows to pick up the phone and talk directly to each other in the event of an issue.

Chinese state-media took a positive tone on the relationship in the days up to the meeting, marking an about-face from harsher views just weeks ago. And Xi, on his first visit to the U.S. in six years, pushed back on talk of a decoupling, saying it wasn’t an option for the two countries to turn their backs on each other.

The visit will likely be sold in China as Xi putting the relationship back on track, a welcome development in China where there is still a relatively positive view of the U.S. among the people, says Matthews Asia investment strategist Andy Rothman.

The meeting on the sidelines of the Asia-Pacific Economic Cooperation summit in San Francisco came on the heels of another development that lowered the geopolitical risk level: a surprise move by Taiwan’s two main opposition parties to jointly back a candidate in the Jan. 13 presidential election. That increases the chances of an outcome that could help Taipei-Beijing relations and remove the risk of a unilateral push for Taiwan’s sovereignty, says Marko Papic, chief strategist at alternatives asset manager Clocktower Group.

But investors like Papic need Beijing to increase stimulus to revive its economy to get them more interested in Chinese stocks. A spate of October data, from retail sales to private sector credit growth, showed growth to be still anemic and confidence still beaten up as fixed-asset investment contracted further.

Others are still worried about the direction of U.S.-China relations, especially as past vows have not always been followed up with action. Indeed, when asked if he trusted Xi at a press conference after the meeting Wednesday, Biden responded with the need to “trust and verify.”

“We are in a competitive relationship—China and the U.S.—but my responsibility is to make this rational and manageable so it doesn’t result in a conflict. That’s what this is about,” Biden said.

That competitive relationship though is pushing both countries to become more self-reliant and find ways to counter each other while global companies are reassessing their exposure to China.

Indeed, in its annual report to Congress, the U.S.-China Economic and Security Review Commission advised lawmakers to push for more disclosures on outbound investments into China, as well as increased scrutiny of universities, companies and investors and their exposure to China.

The commission also said it would be looking more closely at artificial intelligence, especially as commissioners said China has embraced the technology as part of the modernization of its military.

Despite the softer tone out of the Xi-Biden meeting, few see the Biden administration letting up on its efforts to counter China, especially as candidates running for the Republican presidential campaign complain Biden hasn’t been tough enough.

While the meeting may have taken some of the worst-case fears of a U.S.-China conflict off the table for now, enough risks persist—both related to the rivalry between the two countries and China’s economic prospects—that could keep investors on the sidelines still.

Write to Reshma Kapadia at [email protected]

Read the full article here