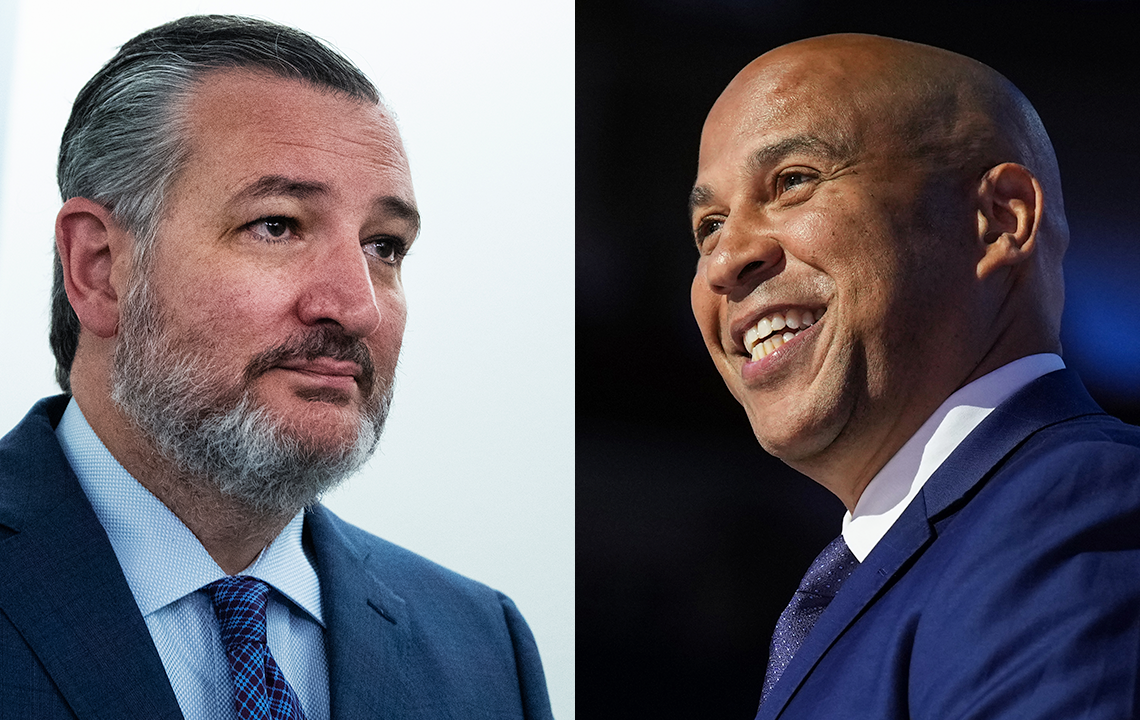

Sens. Ted Cruz, R-Texas, and Cory Booker, D-N.J., urged leaders of Fortune 1000 companies in a letter Tuesday to support the newly created federal savings program known as “Trump Accounts,” a tax-advantaged investment account established for newborn American children.

The program, created by the One Big Beautiful Bill Act and signed into law by President Donald Trump July 4, provides every child born between Jan. 1, 2025 and Dec. 31, 2028, a one-time $1,000 government deposit at birth. Families can open an account once the child has a Social Security number, and funds cannot be withdrawn until the child turns 18.

“These accounts will launch a once-in-a-generation expansion of economic opportunity and prosperity for every American child, helping millions of families realize the American dream through homeownership, education, or entrepreneurship,” the senators wrote.

WHITE HOUSE UNVEILS ‘TRUMP ACCOUNTS’ FOR CHILDREN WITH $6.25B DELL INVESTMENT

The senators also emphasized the long-term financial benefits.

“These tax-advantaged accounts ensure that every American child is an immediate shareholder in America’s largest companies and will experience the miracle of compound growth through their lifetime,” they wrote.

“We believe these accounts — much like 401(k)s — represent a transformative tool for building long-term financial security, expanding economic prosperity, and fundamentally restoring confidence in American capitalism.”

The letter also urged businesses to join the effort.

“Many companies have already pledged support, and we encourage your company to explore how you might contribute at a level aligned with your mission and capacity. By matching contributions for employees’ families, investing in the communities where you operate, or integrating these accounts into your philanthropic strategy, you can significantly enhance the impact of this historic initiative.”

The bipartisan call comes on the heels of a $6.25 billion investment from Michael Dell, founder and CEO of Dell Technologies, and his wife, Susan.

MICHAEL AND SUSAN DELL DONATE $6.25B TO FUND ‘TRUMP ACCOUNTS’

The two joined Trump at the White House to share additional details about their pledge, which is the program’s first major infusion of private funding.

“These investment accounts are simple, secure and structured to grow in value through market returns over time. At age 18, these young Americans can have a financial foundation for continued education, job training, home ownership or future savings. It’s a simple yet very powerful idea,” the couple said in a statement.

Trump called the investment from the Dell family an “amazing” and “generous act” and said he would also make a donation to the federal savings program.

The Treasury Department estimates that the Trump accounts could accumulate into a seven-figure balance by early adulthood if families maximize their contributions.

A fully funded account could reach as much as $1.9 million by age 28, according to the Treasury’s Office of Tax Analysis. Even at the lower end of projected returns, the savings account could still yield nearly $600,000 over the same period.

Even without additional contributions beyond the federal government’s initial $1,000 deposit, Treasury estimates the account could grow to between $3,000 and $13,800 over 18 years.

Read the full article here